Do you hate budgeting?

Ok, so what’s the one thing you hate most about budgeting? Sticking to the budget? Writing everything down? It’s too time consuming and hard?

All of the above? You hate all of it?

Somehow, I knew you would say that. Why? Because I feel the same way. When I was a teenager, my mom tried to follow a budget. She didn’t always stick to it, but she tried. I’d see her sitting at the kitchen table writing everything down, doing the math, and trying to figure things out. Then, she would call us over and make us sit down and discuss the budget (which was torture). Seriously, I’d rather go to the dentist.

She didn’t always stick to the budget, but when she did, it worked. The idea was in her mind. But, after that, I always swore I’d never create a budget. Because they suck. There, I said it. They suck. They suck the life out of you, the free spirit out of you, even the fun right out of you.

But, you know what budgets don’t suck out of you?

- Your plan.

- Your future financial security.

- Your well-being.

If you stick to your budget, these things will fall into place. If your plan stays intact, you can have a free spirit all the way to the bank.

Knowing that I am returning to the world of budgeting. I’m not running, but I’m going. We need a budget. I wouldn’t say that I’m bad with money (if my husband reads this post, this is the spot where he will laugh out loud). No really, I’m not bad with money. I don’t spend a lot of money, but I don’t always keep track of where it’s going. And, that’s not being good with money.

I actually get excited over buying things dirt cheap at the thrift store when the original price was a lot higher. That gets me excited. I once bought a brand new $50 Ralph Lauren shirt for the hubs for the thrifty price of $3. Every time he wears it I get excited. I have no problem letting someone else pay full price for something, and then buying it for one-tenth of the price. It’s a great feeling. And you know what? No one knows I paid $3 for it. No one.

Be sure to download the free Basic Budget Worksheet below.

Where does all the money go?

If I’m not budgeting, I could end up spending a lot of money at the thrift store without even realizing it.

I used to drink Starbucks quite a bit. I love the stuff. But, if you’re going there often, it adds up, just like the thrift store. Financial guru David Bach coined the phrase, “Latte Factor,” which is a strategy to save money. If you get a latte often, the money is going to add up. He points out that you could be saving that money instead, and building up wealth. Basically, here’s how the math breaks down:

If you get Starbucks every day for even one year, it will add up. If you saved that money, with an annual interest rate of just 5%, you’d have $1916.25. That’s more than a few house payments.

If you spent the next 40 years saving your money, at the same rate, you’d have $231,482. 57. That’s a TON of money! That kind of money would buy a really nice house, or pay for your kid’s college tuition. You don’t want to drink that house or tuition away at Starbucks.

(I used the calculator on his website to find these numbers. You can find it here: David Bach Latte Factor).

When I went back over my checkbook, I realized I was guilty of spending money needlessly in places like Starbucks and the thrift store.

The entire objective of having a budget is to avoid money slipping through your fingers.

[Tweet “The entire objective of having a budget, is to avoid money slipping through your fingers.”]

So, how do I get started on the budget?

First, write everything down. Every bit of it. Just grab a piece of paper and start writing everything down that you spent money on last month. It doesn’t even have to be neat or pretty.

Don’t stress over what you spent last month, either. It’s what you spent–it is what it is. Can’t go back. You can only look toward the future. But, you can’t really look until it’s on paper. Take thirty minutes to write it down. Need a break? Go take one. But, if you need coffee, go make it in the kitchen. Just don’t go to the coffee shop – ha!

- Mortgage

- Water bill

- Gas bill

- Electric bill

- Cell phone bill

- Credit cards

- Fuel for vehicles

- Groceries

- Car payments

- Clothing

- Nails

- Tools

- Eating out

- Coffee

- Entertainment

- Piano lessons for the kids

- Sports for the kids

- Childcare

- If you spent money on it, write it down

Once you write everything down, you will see where a lot of your money is going. You will be able to see how much you’re spending.

Now, add all of that up. Need a second strong cup of coffee? I get it (wink, wink–I’m right there with you).

Write down your income

- Job income

- Rentals

- Side jobs

- eBay

- etc.

You’ve overcome the hardest part of the budget. I’m not asking you to cut things out now, just look at them. Once you have things written down, you can see where the money is going, and you can see where the money is coming in.

Make a plan

The nice thing about having a simple and realistic budget is that I can have a weekly plan. Because I’m not going to remember what I spent over the course of the month unless I write it down on a regular basis.

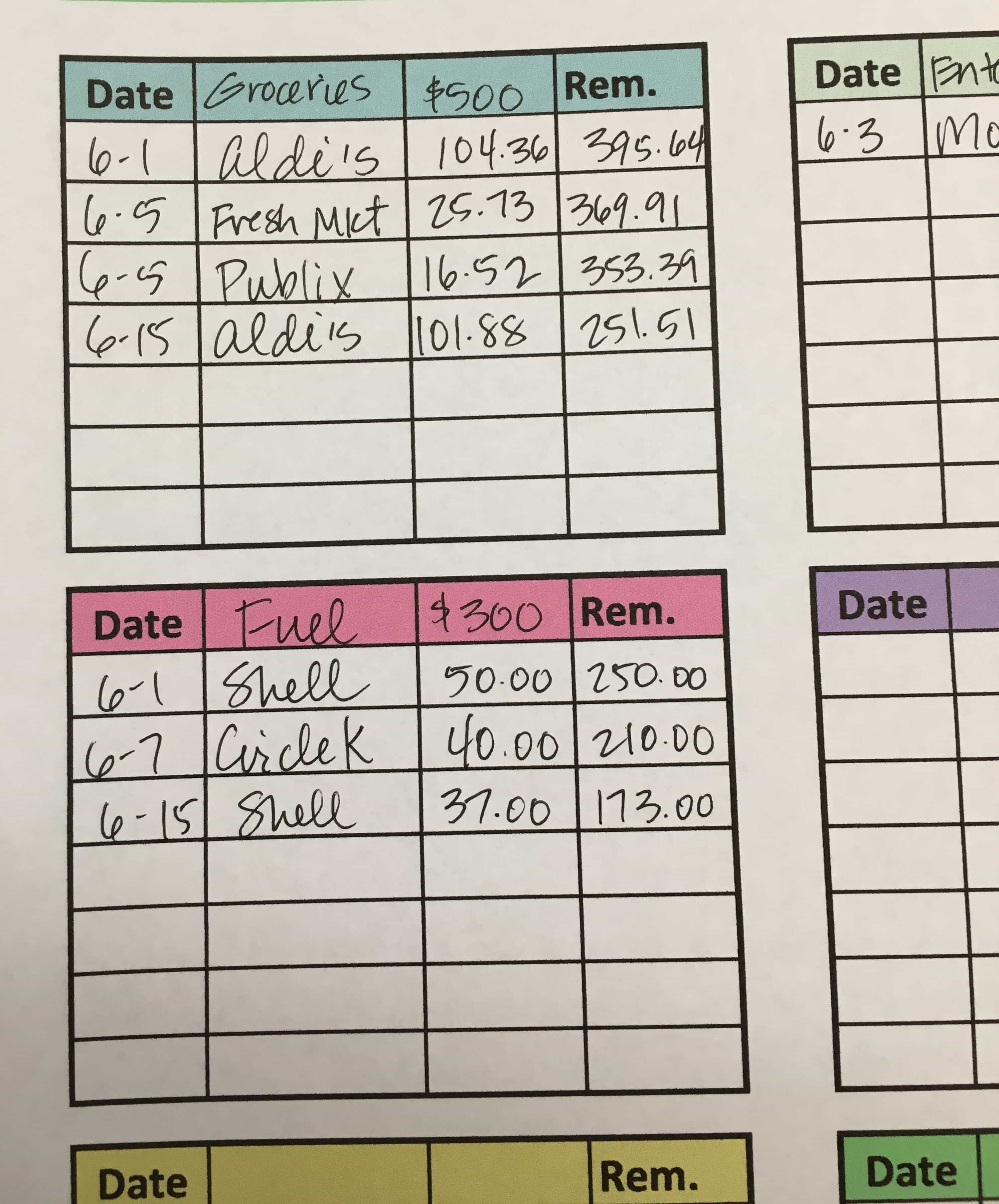

I went to the store earlier today and thought I was doing great. I’ve given our family a $500 a month grocery budget. I stood in line thinking about how great I was for only spending $150 so far. Then, I got home and pulled up my checking account online and completely forgot that I had spent more on other items at another store. Oops!

So, I got to work. I’ve created the most basic budget sheet out there. Start by figuring out how much you want to spend in each category.

Simply, enter each budget amount, and keep track of how much you spend. The balance will fall in the right column, and you’ll always know how much money you have remaining in that particular category.

I can take the worksheet of paper with me everywhere, or I can keep it at home and fill it out when I return from the store. If I leave it out on the counter, I can check it before I head out, and know how much I can spend. So can you! It’s that easy.

Here’s a glance at your simple and realistic budget:

It’s a simple way of keeping track of how much you’re spending. You don’t have to be great at math (I’m not), and it takes only a few minutes to write down the amount you spent.

The great thing about this simple budget is that you’re not spending hours sitting at the computer entering numbers. You look at the basic budget before you shop, and you write it down on the sheet when you get home.

The simple and realistic budget worksheet gives the power back to you, especially when you see how much is left in your account at the end of the month to add to savings. It’s a great feeling to know you’ve accounted for all of your money.

I’d love to hear your comments. Let me know how things are going!

Click here to grab the Basic Budget Worksheet and print it out today!

If you’d like a budget that is more in depth, I recommend Dave Ramsey. I am a member of Financial Peace University, and it’s worth every penny.

Looking for other ways to save money? Click the links below: